WMG posts $59m loss in FY Q2 ended March 31 2014

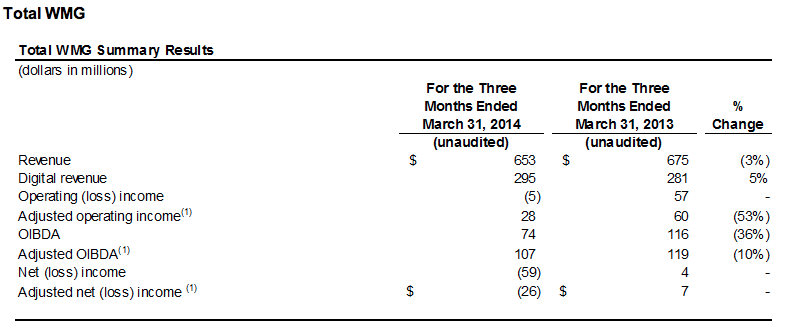

Warner Music Group recorded a $59 million net loss in its second fiscal quarter ended March 31 2014. That compares to an income of $4 million in the prior-year quarter. For the quarter, revenue declined 3.3% (or 2.7% in constant currency). Excluding the July 1, 2013 acquisition of Parlophone Label Group, revenue declined 13.9% (or 13.4% in constant currency), due to a lighter release schedule than in the prior-year quarter.

Including PLG, the growth in artist services and expanded rights revenue, digital revenue and recorded music licensing revenue was more than offset by declines in recorded music physical revenue and music publishing mechanical and performance revenue. Constant-currency revenue growth in the UK, Italy, France and other parts of Europe, driven in part by the PLG acquisition, was more than offset by declines in the US, Canada, Japan and other parts of Asia.

Digital revenue grew 5.0% (or 5.7% in constant currency), and represented 45.2% of total revenue, compared to 41.6% in the prior-year quarter.

Growth in digital revenue reflects the acquisition of PLG as well as growth in streaming revenue, partially offset by declines in download revenue largely resulting from the release schedule, according to the company.

Excluding PLG, digital revenue declined 5.3% (or 4.7% in constant currency).

Adjusted net loss was $26 million compared to adjusted net income of $7 million in the prior-year quarter.

As of March 31, 2014, the company reported a cash balance of $149 million, total long-term debt of $2.869 billion and net debt (total long-term debt, including the current portion, minus cash) of $2.720 billion. There was no balance outstanding on the revolver as of March 31, 2014.

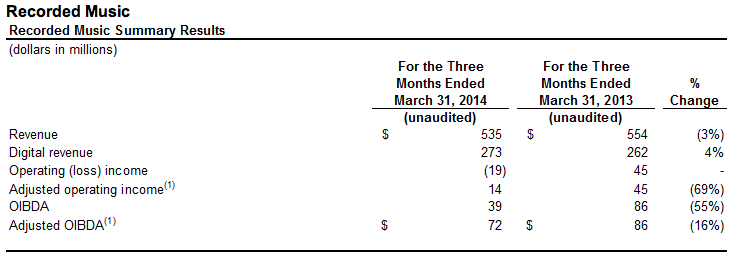

Recorded music revenue declined 3.4% (or 2.7% in constant currency). Excluding PLG, revenue declined 16.4% (or 15.8% in constant currency) due to the release schedule, according to the company.

Including PLG, artist services and expanded-rights revenue, digital revenue and licensing revenue all grew, but were more than offset by a decline in physical revenue. Artist services and expanded rights revenue growth was primarily driven by an increase in concert promotion revenue in Italy and France. Licensing revenue growth was driven by the acquisition of PLG.

Digital revenue growth of 4.2% (or 5.0% in constant currency) was driven by the acquisition of PLG as well as growth in streaming revenue. Digital revenue represented 51.0% of total recorded music revenue, compared to 47.3% in the prior-year quarter. Domestic recorded music digital revenue was $139 million, or 63.5% of total domestic recorded music revenue. Excluding PLG, digital revenue declined 6.9% (or 6.2% in constant currency). Major sellers included Bruno Mars, Jason Derulo, Macklemore & Ryan Lewis, Kylie Minogue and Passenger.

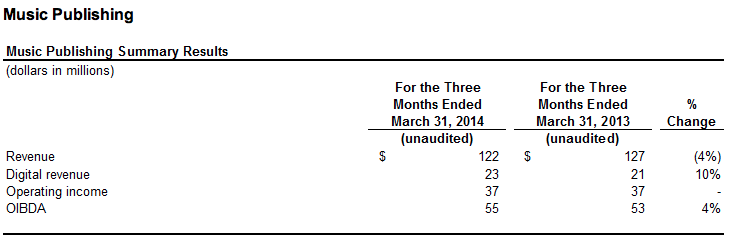

Music publishing revenue declined 3.9% on both an as-reported and constant-currency basis. Digital revenue grew 9.5%, on both an as-reported and constant-currency basis, due to growth in streaming revenue, according to the company.

Synchronisation revenue was flat (or down 3.6% in constant currency), reflecting the timing of deals. Performance revenue was down $1 million, or 2.1% (4.1% in constant currency), which WMG says was driven by the timing of collection society distributions. Mechanical revenue fell 18.5%, on both an as-reported and constant-currency basis, due to the continued transition from physical to digital sales.

Source: Music Week