RIAA Accounting: Why Even Major Label Musicians Rarely Make Money From Album Sales

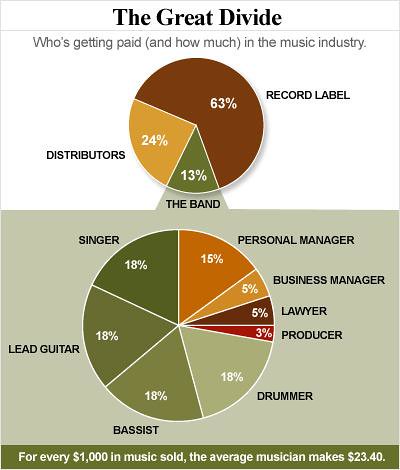

We recently had a fun post about Hollywood accounting, about how the movie industry makes sure even big hit movies “lose money” on paper. So how about the recording industry? Well, they’re pretty famous for doing something quite similar. Reader Jay pointed out in the comments an article from The Root that goes through who gets paid what for music sales, and the basic answer is not the musician. That report suggests that for every $1,000 sold, the average musician gets $23.40.

Here’s the chart that the article shows, though you should read the whole article for all of the details:

Source: TheRoot.com

Of course, it’s actually even more ridiculous than this report makes it out to be. Going back ten years ago, Courtney Love famously laid out the details of recording economics, where the label can make $11 million… and the actual artists make absolutely nothing. It starts off with a band getting a massive $1 million advance, and then you follow the money:

What happens to that million dollars?

They spend half a million to record their album. That leaves the band with $500,000. They pay $100,000 to their manager for 20 percent commission. They pay $25,000 each to their lawyer and business manager.

That leaves $350,000 for the four band members to split. After $170,000 in taxes, there’s $180,000 left. That comes out to $45,000 per person.

That’s $45,000 to live on for a year until the record gets released.

The record is a big hit and sells a million copies. (How a bidding-war band sells a million copies of its debut record is another rant entirely, but it’s based on any basic civics-class knowledge that any of us have about cartels. Put simply, the antitrust laws in this country are basically a joke, protecting us just enough to not have to re-name our park service the Phillip Morris National Park Service.)

So, this band releases two singles and makes two videos. The two videos cost a million dollars to make and 50 percent of the video production costs are recouped out of the band’s royalties.

The band gets $200,000 in tour support, which is 100 percent recoupable.

The record company spends $300,000 on independent radio promotion. You have to pay independent promotion to get your song on the radio; independent promotion is a system where the record companies use middlemen so they can pretend not to know that radio stations — the unified broadcast system — are getting paid to play their records.

All of those independent promotion costs are charged to the band.

Since the original million-dollar advance is also recoupable, the band owes $2 million to the record company.

If all of the million records are sold at full price with no discounts or record clubs, the band earns $2 million in royalties, since their 20 percent royalty works out to $2 a record.

Two million dollars in royalties minus $2 million in recoupable expenses equals … zero!

How much does the record company make?

They grossed $11 million.

It costs $500,000 to manufacture the CDs and they advanced the band $1 million. Plus there were $1 million in video costs, $300,000 in radio promotion and $200,000 in tour support.

The company also paid $750,000 in music publishing royalties.

They spent $2.2 million on marketing. That’s mostly retail advertising, but marketing also pays for those huge posters of Marilyn Manson in Times Square and the street scouts who drive around in vans handing out black Korn T-shirts and backwards baseball caps. Not to mention trips to Scores and cash for tips for all and sundry.

Add it up and the record company has spent about $4.4 million.

So their profit is $6.6 million; the band may as well be working at a 7-Eleven.

And that explains why huge megastars like Lyle Lovett have pointed out that he sold 4.6 million records and never made a dime from album sales. It’s why the band 30 Seconds to Mars went platinum and sold 2 million records and never made a dime from album sales. You hear these stories quite often.

And note that those are bands that are hugely, massively popular. How about those that just do okay? Remember last year, when Tim Quirk of the band Too Much Joy revealed how Warner Music made a ton of money of of the band’s albums, but simply refuses to accurately account for royalties owed, because the band is considered unrecoupable. Sometimes the numbers even go in reverse. If you don’t understand RIAA accounting, you might think that if a band hasn’t “recouped” its advance, it means that the record labels lost money. Not so in many cases. Quirk explained the neat accounting trick in a footnote to his post about his own royalty statement:

A word here about that unrecouped balance, for those uninitiated in the complex mechanics of major label accounting. While our royalty statement shows Too Much Joy in the red with Warner Bros. (now by only $395,214.71 after that $62.47 digital windfall), this doesn’t mean Warner “lost” nearly $400,000 on the band. That’s how much they spent on us, and we don’t see any royalty checks until it’s paid back, but it doesn’t get paid back out of the full price of every album sold. It gets paid back out of the band’s share of every album sold, which is roughly 10% of the retail price. So, using round numbers to make the math as easy as possible to understand, let’s say Warner Bros. spent something like $450,000 total on TMJ. If Warner sold 15,000 copies of each of the three TMJ records they released at a wholesale price of $10 each, they would have earned back the $450,000. But if those records were retailing for $15, TMJ would have only paid back $67,500, and our statement would show an unrecouped balance of $382,500.

I do not share this information out of a Steve Albini-esque desire to rail against the major label system (he already wrote the definitive rant, which you can find here if you want even more figures, and enjoy having those figures bracketed with cursing and insults). I’m simply explaining why I’m not embarrassed that I “owe” Warner Bros. almost $400,000. They didn’t make a lot of money off of Too Much Joy. But they didn’t lose any, either. So whenever you hear some label flak claiming 98% of the bands they sign lose money for the company, substitute the phrase “just don’t earn enough” for the word “lose.”

So, back to our original example of the average musician only earning $23.40 for every $1,000 sold. That money has to go back towards “recouping” the advance, even though the label is still straight up cashing 63% of every sale, which does not go towards making up the advance. The math here gets ridiculous pretty quickly when you start to think about it. These record label deals are basically out and out scams. In a traditional loan, you invest the money and pay back out of your proceeds. But a record label deal is nothing like that at all. They make you a “loan” and then take the first 63% of any dollar you make, get to automatically increase the size of the “loan” by simply adding in all sorts of crazy expenses (did the exec bring in pizza at the recording session? that gets added on), and then tries to get the loan repaid out of what meager pittance they’ve left for you.

Oh, and after all of that, the record label still owns the copyrights. That’s one of the most lopsided business deals ever.

So think of that the next time the RIAA or some major record label exec (or politician) suggests that protecting the record labels is somehow in the musicians’ best interests. And then, take a look at the models that some musicians have adopted by going around the major label system. They may not gross as much without the major record label marketing push behind them, but they’re netting a whole lot more, and as any business person will tell you (except if that business person is a major label A&R guy trying to sign you to a deal), the net amount is all that matters.

Source: Techdirt News